does fanduel report winnings to irs|Effective Strategies to Handle Tax Withholding on FanDuel : Tagatay FanDuel is legally prohibited from providing tax advice and unfortunately cannot answer this question. Instead, we highly suggest you reach out to a professional . Tingnan ang higit pa

Those in CST on the other hand, looking to contact those in JST, will find it best to schedule meetings between 6:00pm and 3:00am as that is when they will most likely be at work as well. Quickly and easily compare or convert JST time to CST time, or the other way around, with the help of this time converter. Below, you can see the complete .

PH0 · Understanding Fanduel Earnings Taxes: Common FAQs Answered

PH1 · Taxes with FanDuel Sportsbook

PH2 · Taxes with FanDuel Casino

PH3 · Taxes on Sports Betting: How They Work, What’s

PH4 · Tax Considerations for Fantasy Sports Fans

PH5 · Sports Betting Taxes: How to Handle DraftKings, FanDuel

PH6 · Frequently Asked Questions

PH7 · Form W

PH8 · Fantasy Sports Tax Rules: Don’t Press Your Luck Against the IRS

PH9 · Effective Strategies to Handle Tax Withholding on FanDuel

5167 US Dollar(USD) to Guatemala Quetzal(GTQ) 40064.95934: 614 Euro(EUR) to Mexican Peso(MXN) 12629.67184: 78 US Dollar(USD) to Philippine Peso(PHP)

does fanduel report winnings to irs*******Taxes - Frequently Asked Questions - W-2G, 1099, winnings and more

Understanding Fanduel Earnings Taxes: Common FAQs AnsweredTaxes - Frequently Asked Questions - W-2G, 1099, winnings and moreEffective Strategies to Handle Tax Withholding on FanDuel WinningsWe do not report annual profit or loss to the IRS for FanDuel Sportsbook, Casino, or Racing. FanDuel is required to report certain wagering transactions to the IRS on Form W-2G (s), but only when a transaction meets a very specific set of criteria. Tingnan ang higit paFanDuel is legally prohibited from providing tax advice and unfortunately cannot answer this question. Instead, we highly suggest you reach out to a professional . Tingnan ang higit paSome Tax Forms from previous calendar years are available following this link.All you need to do is click the applicable FanDuel products that you play on, select the . Tingnan ang higit paEffective Strategies to Handle Tax Withholding on FanDuel The Player Activity Statement is a summary of your FanDuel wallet and gameplay activity. It summarizes transactional movement such as deposits, withdrawals, winnings, bets, and more. Learn more about the Player Activity Statement. Tingnan ang higit pa

Tax Forms for a particular Tax year will be available for download on or after January 31st of the year after the calendar year in question. For example, 2023 Tax Forms will be . Tingnan ang higit paWe do not report annual profit or loss to the IRS for FanDuel Sportsbook, Casino, or Racing. FanDuel must report certain wagering transactions to the IRS on Form W-2G .

If you use online sportsbooks like DraftKings, PointsBet, and FanDuel, you might need to pay taxes. Learn the taxes you’ll pay, how to file your sports betting . Fanduel operates under the guidelines of the Internal Revenue Service (IRS). They issue a 1099-Misc tax form for winnings over $600. However, if you win .

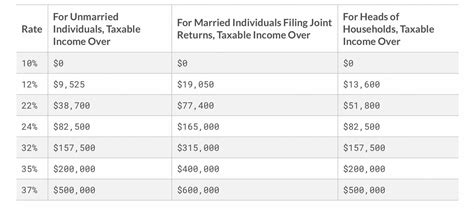

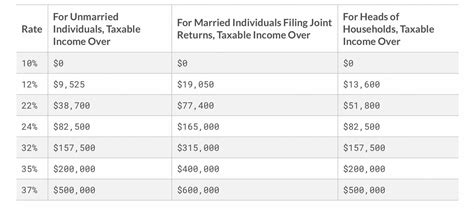

Fantasy sports winnings of $600 or more are reported to the IRS. If it turns out to be your lucky day and you take home a net profit of $600 or more for the year playing on . FanDuel, as a responsible payor, adheres to IRS guidelines and withholds federal tax from certain winnings. This includes winnings over $600 in a year, from off . The IRS requires U.S. citizens to report all gambling winnings as income, whether or not they receive a W2-G. Winnings from gambling, lotteries, and contests must be reported as "Other. Gambling businesses are required to report payouts they made that meet certain thresholds, according to the IRS. You'll likely receive one or more W-2G forms if you:

Starting point: If you play Fantasy sports online for money and win $600 or more, the sponsoring website is legally obligated to report the winnings. Typically, .

Does FanDuel report my annual profit or loss on Casino to the IRS? We do not report annual profit or loss to the IRS for FanDuel Sportsbook, Casino, or Racing. FanDuel . As per the federal tax laws, individuals are required to report all gambling winnings, including those from platforms like FanDuel, on their tax returns. This responsibility exists independently of any reporting practices by FanDuel. Highlighting potential consequences of failing to report earnings from FanDuel. Failure to report . A payer is required to issue you a Form W-2G, Certain Gambling Winnings if you receive certain gambling winnings or have any gambling winnings subject to federal income tax withholding. You must report all gambling winnings on Form 1040 or Form 1040-SR (use Schedule 1 (Form 1040) PDF), including winnings that aren't reported on . The IRS states: "Gambling winnings are fully taxable and you must report the income on your tax return." That covers lottery winnings, raffles, horse races, and casinos.does fanduel report winnings to irs Effective Strategies to Handle Tax Withholding on FanDuel Think of it like your weekly paycheck. If any taxes on your winnings have already been withheld, make sure to report that on the 1099 or W2-G. If you never got one, contact your sportsbook or casino. State to State. If you report your sports betting winnings to the IRS, states will be aware too and want to tax it. If your home state has . Gambling winnings are fully taxable according to IRS regulations but gambling losses can be deductible up to the amount of your winnings if you choose to itemize deductions on your tax return.Reporting if net winnings ≥ $1,500; Sportsbook, Casino Table and Live Dealer games. Reporting if net winnings ≥ $600 and odds ≥ 300:1 (+30000) 24% withholding if net winnings ≥ $5,000 and odds ≥ 300:1; Sweepstakes, Paid Pools, and Lotteries. Reporting if net winnings ≥ $600 and are at least 300 times the amount wagered First, we’ll state that you must report any winnings to the IRS. FanDuel sportsbook strongly advises you to get an expert to do this task. This is particularly true if you win a substantial sum of money or a wager with long-shot odds. Gambling taxes: You have to report all your winnings. Whether it's $5 or $5,000, . And be sure you report all your gambling winnings. The IRS isn't typically hunting down small-time winners, but .Get answers for your Sportsbook, Casino, Daily Fantasy, TVG, Racing, or Faceoff questionsdoes fanduel report winnings to irsFanDuel would tip off the IRS of your winnings by way of a form called a W2-G. You can look up FanDual’s W2-G policy to see if you are getting one, or just wait until January for it to come in the mail, but regardless of whether you get a W2-G, you have an obligation to report any and all income, even if you are a 6 year old with a lemonade .

Gambling businesses are required to report payouts they made that meet certain thresholds, according to the IRS. You'll likely receive one or more W-2G forms if you: Won $1,200 or more playing . Like DraftKings, FanDuel is a massive player in the sports betting market, with sportsbooks operating in multiple states. And, like DraftKings, FanDuel customers are subject to the same federal . When a player makes a bet on FanDuel and earns over $600, the platform reports it to the IRS if the odds are 300 to 1 or greater. FanDuel also sends a W2-G form to both the IRS and the player that they can use when filing taxes later. However, when a player earns over $5,000 on a wager, FanDuel withholds 25% of the winnings for tax .

Does FanDuel report my annual profit or loss on Sportsbook, Casino, or Racing to the IRS? We do not report annual profit or loss to the IRS for FanDuel Sportsbook, Casino, or Racing. FanDuel is required to report certain wagering transactions to the IRS on Form W-2G(s), but only when a transaction meets a very specific set of criteria.

Generally, your net profit for tax purposes is the amount of your winnings minus any entry fee. For instance, say you win $10,000 in a big stakes league and your entry fee was $1,000. As a result . Check your state’s specific guidelines on their gambling winnings tax rate when it comes time to report your winnings. How to report your gambling winnings on your taxes Reporting your gambling winnings is a crucial step in getting your taxes done and staying in the good graces of the IRS. If you’ve won a substantial amount, the payer . File Form W-2G, Certain Gambling Winnings, to report gambling winnings and any federal income tax withheld on those winnings. The requirements for reporting and withholding depend on the type of gambling, the amount of the gambling winnings, and generally the ratio of the winnings to the wager. File Form W-2G with the IRS.Hey everyone, So I won a $7.5k pool in FanDuel, and I was wondering if I pay taxes on that amount if I don't pull the money out of FanDuel. I think I don't because I can only send the money on more gambling on the FanDuel site unless I transfer it to my bank account.

ARO Visayas Schedule and Online Registration 2024. Here is the Schedule for the Pre-Entry Exam for Officer Candidate Course in ARO Visayas. Pre-entry Exam includes AFPSAT, AQE, and SWE.If you are interested in joining the army, see the schedule below:. 20-22 Jan 2024- Dumaguete City

does fanduel report winnings to irs|Effective Strategies to Handle Tax Withholding on FanDuel